Start Earning

Earn More, Live Rich: Your Guide to Boosting Income as a Student

As a student in the Netherlands, you have plenty of opportunities to earn extra money, whether through part-time work, side hustles, or using your skills in the gig economy. This page is designed to help you find creative ways to boost your income, so you can save, invest, and live a more financially secure student life.

Why Should I Focus on Earning More?

While saving is crucial, increasing your income can significantly accelerate your financial progress. By earning extra money as a student, you can:

- Cover living expenses and avoid the stress of constant budgeting.

- Boost your savings to create an emergency fund or achieve your financial goals.

- Build valuable skills that will benefit your career after graduation.

- Pay off debt faster if you have student loans or other financial obligations.

Earning more gives you the flexibility to enjoy student life while also investing in your financial future.

Top 5 Ways to Earn More as a Student in the Netherlands

-

Part-Time Jobs

- One of the most common ways students increase their income is by getting a part-time job. The Netherlands offers plenty of opportunities for students in various industries, including retail, hospitality, tutoring, and administrative work.

Quick Tip: If you’re fluent in English, many international companies in the Netherlands offer part-time roles in marketing, customer support, or data entry. Websites like StudentJob.nl, Indeed.nl, and LinkedIn are great places to start your job search.

-

Freelancing & Remote Work

- Use your skills to start freelancing in areas like writing, graphic design, web development, or digital marketing. Freelancing can be done on your own schedule, making it a great way to earn extra money without disrupting your studies.

Quick Tip: Create profiles on freelancing platforms like Upwork, Fiverr, or Freelancer.com to find opportunities that match your skills. Don’t forget to leverage your student network for referrals!

-

Tutoring and Teaching

- If you excel in a subject, consider offering tutoring services to fellow students or high schoolers. With many students in the Netherlands looking for extra help in subjects like math, languages, or economics, tutoring can be a rewarding and profitable way to earn.

Quick Tip: Platforms like Superprof or Preply make it easy to connect with students who need tutoring, or you can offer private lessons to classmates through university bulletin boards.

-

Gig Economy Jobs

- The gig economy offers many flexible ways to earn money, such as driving for Uber, delivering food with Deliveroo, or running errands via TaskRabbit. These jobs allow you to earn on your own schedule and are a great way to boost your income when you have free time between classes.

Quick Tip: Sign up for gig platforms like Bolt, Uber Eats, and Thuisbezorgd to find flexible work. Just be sure to manage your time so that your studies don’t suffer!

-

Online Sales and E-commerce

- If you have an entrepreneurial spirit, you can start an online store or sell items you no longer need. Platforms like eBay, Marktplaats, or Etsy offer opportunities to sell products, whether they’re second-hand items or handmade crafts.

Quick Tip: Use social media platforms like Instagram or Facebook Marketplace to promote your products and reach potential customers in the local community.

Leveraging Your Student Status

Being a student in the Netherlands gives you access to special benefits and opportunities that can help you earn money more efficiently. Here’s how to make the most of your student status:

-

Student Discounts and Deals

- Many companies offer student discounts on products and services. These discounts can add up and free up more money for savings or investments.

Quick Tip: Use student discount apps like UNiDAYS or StudentenNet to stay updated on the latest deals. Take advantage of discounts on everything from food and tech gadgets to fashion and entertainment.

-

Student Research Participation

- Universities and research organizations in the Netherlands often need students to participate in studies or surveys. In exchange, you can earn cash or gift cards.

Quick Tip: Check out your university’s research center or online platforms like Prolific and Survey Junkie to find paid study opportunities.

-

Scholarships & Grants

- Don’t forget to look for scholarships or grants available to students in the Netherlands. Scholarships can provide extra funds to cover your tuition or living expenses.

Quick Tip: Use websites like GrantFinder or Scholarships.com to search for scholarships and grants specifically for international students or Dutch students in your field of study.

How to Manage Your Earnings Wisely

- Track Your Income: Use apps like Mint, YNAB, or Monzo to track your income, expenses, and savings. This will help you stay on top of your finances and avoid overspending.

- Set Financial Goals: Whether you're saving for an emergency fund, paying off debt, or investing in your future, setting clear financial goals will keep you motivated and focused.

- Save a Percentage of Your Earnings: Treat your savings like an expense. Try to save at least 20% of your earnings and set it aside for the future.

- Avoid Lifestyle Inflation: As your income grows, it’s tempting to increase your spending. However, keeping your lifestyle consistent while increasing your income will help you build wealth faster.

Exclusive Opportunities for Members

If you're a Bronze Budgeteer, Silver Saver, or Golden Wealth Builder member, you'll have access to exclusive earning opportunities through our partnerships with companies looking for student talent. You’ll also receive extra resources and tips to help you maximize your income.

To learn more about membership benefits, visit our Memberships page.

Get Started Today!

Whether you’re looking for a part-time job, starting your own side hustle, or exploring freelance opportunities, there’s no better time than now to start earning more. Set your financial goals and take action to make your student life richer!

[Start Earning Now]

Brian, Hogeschool Amsterdam Student

Helpful, guidance and realistic!

"I liked that you summarized at the end of each chapter. The book helped me keep my monthly subscription and expenses on a low budget."

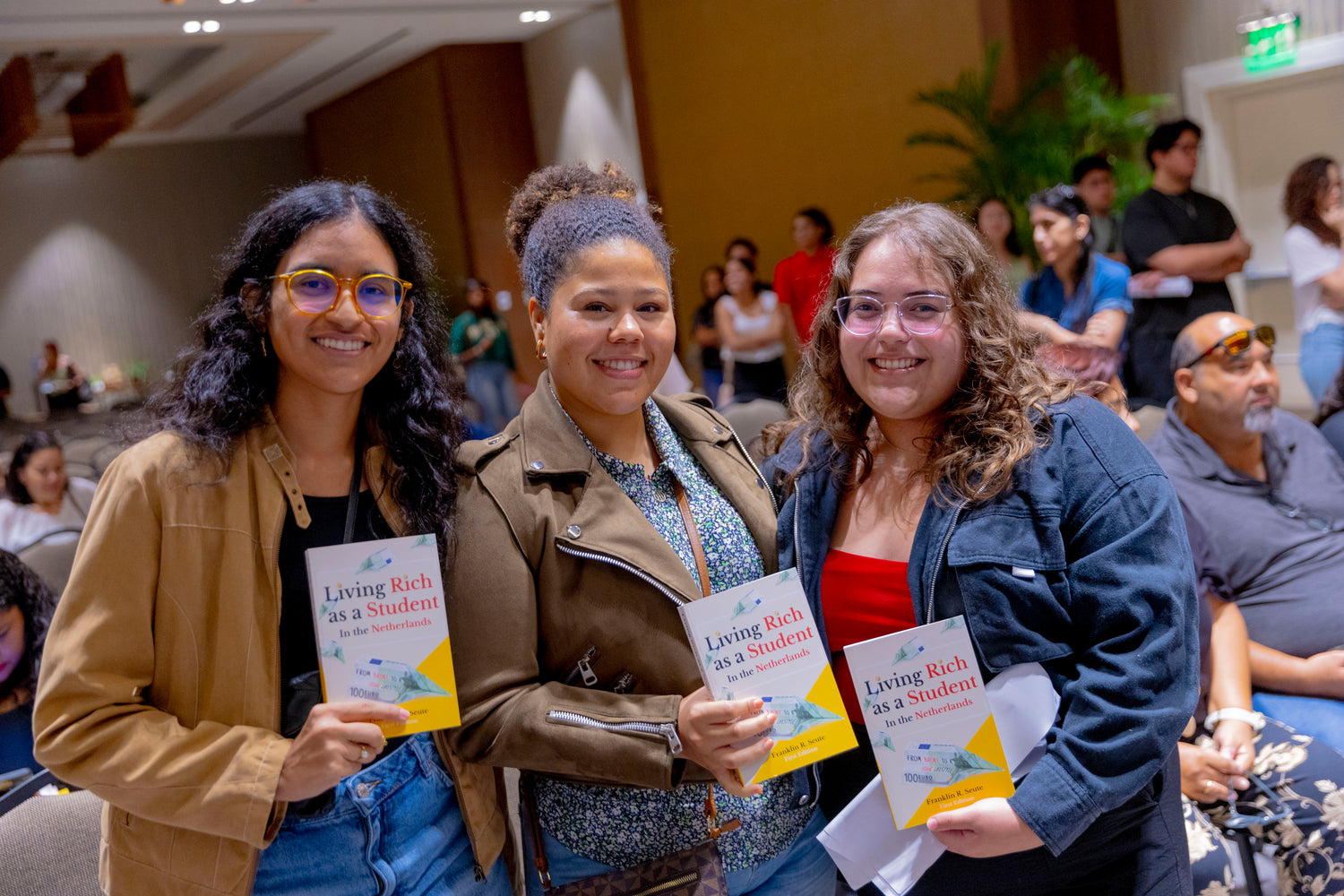

Caption

Row

Pair text with an image to focus on your chosen product, collection, or blog post. Add details on availability, style, or even provide a review.

Caption

Row

Pair text with an image to focus on your chosen product, collection, or blog post. Add details on availability, style, or even provide a review.