Start Investing

Investing as a Student: Grow Your Wealth for the Future

As a student, you might think investing is something for later in life, but starting early can give you a head start toward financial freedom. Even with a limited budget, there are smart ways to begin building wealth for your future while balancing your academic responsibilities. This page is designed to guide you through the basics of investing and help you find options that fit your student lifestyle in the Netherlands.

Why Should Students Start Investing?

While saving is important, investing offers the potential for greater returns over time. Here are a few reasons why you should start investing as a student:

- Compound Interest: The earlier you start investing, the more time your money has to grow thanks to compound interest. Even small amounts invested regularly can add up significantly over time.

- Financial Independence: Building wealth through investments can help you achieve financial independence sooner, allowing you to avoid relying on loans or credit in the future.

- Long-Term Growth: Stocks, bonds, and other investment vehicles tend to appreciate over the long term. By investing early, you position yourself for long-term financial growth.

- Learn Valuable Skills: Starting your investment journey now will teach you valuable financial skills and give you a strong foundation for your future career or business ventures.

Types of Investments for Students in the Netherlands

As a student, you don’t need to have a lot of money to start investing. Here are several investment options that are accessible to students:

-

Stocks & ETFs (Exchange-Traded Funds)

- Overview: Investing in stocks means buying shares in a company, while ETFs allow you to invest in a diversified collection of stocks, bonds, or other assets.

- Why it’s a good option for students: With just a small initial investment, you can buy stocks or ETFs. The Netherlands also has platforms like DEGIRO and BinckBank that allow you to trade stocks and ETFs with low fees.

- How to get started: Choose an online broker, such as DEGIRO or Rabobank, and open an account. Start small with ETFs, as they offer diversification and less risk than individual stocks.

Quick Tip: A low-cost index fund or ETFs like Vanguard Total Stock Market ETF can provide exposure to the market with minimal fees, making it a great starting point for beginners.

-

Peer-to-Peer Lending

- Overview: Peer-to-peer (P2P) lending platforms allow you to lend money to individuals or small businesses in exchange for interest payments.

- Why it’s a good option for students: Platforms like Funding Circle or Bondora let you start investing with small amounts of money. The returns can be higher than traditional savings accounts, but they come with a level of risk.

- How to get started: Sign up with a P2P lending platform, browse the available loans, and choose the ones that fit your risk tolerance.

Quick Tip: Research the platform’s credit ratings and ensure you're comfortable with the potential risks before investing.

-

Cryptocurrency

- Overview: Cryptocurrencies like Bitcoin and Ethereum have gained popularity as alternative investments. These digital currencies operate independently of traditional financial institutions and have the potential for high returns (but also significant volatility).

- Why it’s a good option for students: Cryptocurrencies can be a great way to start investing with relatively small amounts. They also offer the ability to diversify your portfolio.

- How to get started: Use platforms like Coinbase, Binance, or Bitvavo to buy, sell, and store cryptocurrencies. Be sure to start with an amount you’re willing to lose, as the market can be volatile.

Quick Tip: Always do your research before investing in cryptocurrency. It’s highly speculative, so ensure you understand the risks involved.

-

Robo-Advisors

- Overview: A robo-advisor is an online platform that provides automated, algorithm-driven financial planning services with little to no human supervision. These platforms create an investment portfolio for you based on your risk tolerance and goals.

- Why it’s a good option for students: Robo-advisors like WealthSimple or Samantha in the Netherlands require low minimum deposits and offer a simple way to start investing without needing a lot of knowledge or time.

- How to get started: Sign up for a robo-advisor service, complete a risk assessment, and let the algorithm create a diversified portfolio for you. You can often start with as little as €50.

Quick Tip: Robo-advisors are a great option if you want a hands-off investing experience with low fees.

-

Real Estate Crowdfunding

- Overview: Real estate crowdfunding allows you to invest in real estate projects with a small initial investment. You’ll earn a share of the rental income or capital gains when the project is sold.

- Why it’s a good option for students: Crowdfunding platforms like CrowdEstate or RealtyMogul allow you to invest small amounts in real estate projects, diversifying your investment portfolio.

- How to get started: Research platforms that are available in the Netherlands and choose one that fits your risk tolerance. Some platforms offer fractional shares, so you can start investing with a small amount.

Quick Tip: Look for platforms with a proven track record and transparent fees.

How to Get Started with Investing

-

Set Your Financial Goals: Before you start investing, ask yourself: What are you investing for? Whether it’s to build long-term wealth or save for a future purchase, defining your goals will help you decide where to put your money.

-

Start Small: As a student, it’s important to start with a manageable amount of money that you can afford to invest. Don’t risk money you can’t afford to lose, and focus on building your investment portfolio over time.

-

Diversify Your Investments: Don’t put all your money in one investment. Diversifying across stocks, bonds, ETFs, and even peer-to-peer lending will help spread out your risk.

-

Invest Regularly: Even small amounts can add up over time. Set up automatic investments so you contribute to your portfolio each month, ensuring you stay on track to meet your financial goals.

-

Educate Yourself: Take the time to learn about different investment types, markets, and strategies. Read books, follow financial blogs, or take online courses to improve your financial knowledge.

Investing for the Long-Term

Investing is about patience. It might take years before you see significant returns, but if you stay disciplined and invest consistently, your portfolio will grow. Remember, the earlier you start, the more time your investments have to grow. Whether you’re investing in stocks, ETFs, or cryptocurrencies, stay focused on the long-term and continue learning about ways to maximize your returns.

Exclusive Resources for Members

As a Bronze Budgeteer, Silver Saver, or Golden Wealth Builder member, you'll get access to exclusive investment tips, tools, and resources to help you make smarter decisions and grow your wealth even faster.

To learn more about membership benefits and join today, visit our Memberships page.

Start Investing Today!

It’s never too early to begin investing. Take small steps, stay consistent, and watch your money grow. Start your investment journey today and set yourself up for financial success in the future!

[Start Your Investment Journey Now]

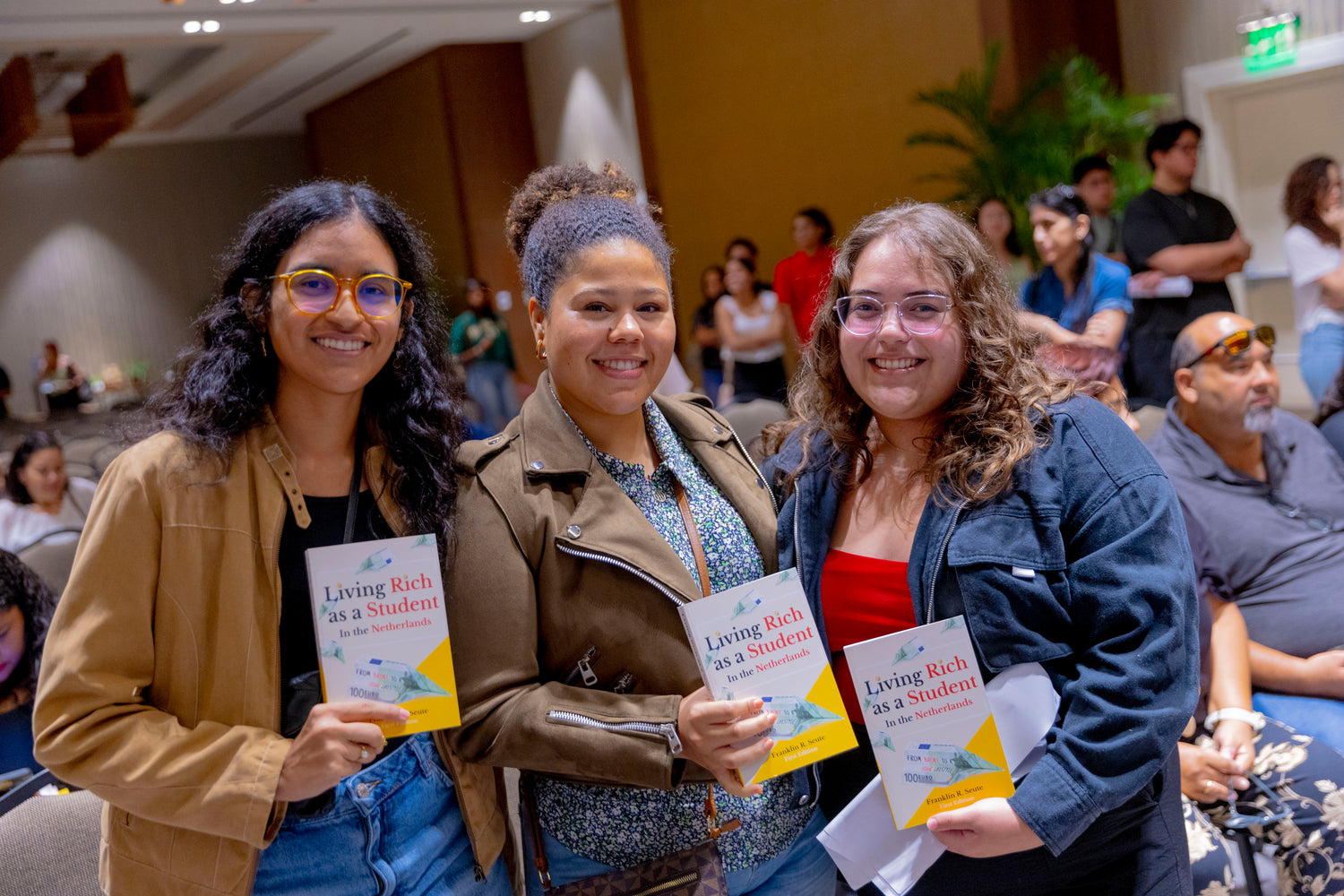

Brian, Hogeschool Amsterdam Student

Helpful, guidance and realistic!

"I liked that you summarized at the end of each chapter. The book helped me keep my monthly subscription and expenses on a low budget."

Caption

Row

Pair text with an image to focus on your chosen product, collection, or blog post. Add details on availability, style, or even provide a review.

Caption

Row

Pair text with an image to focus on your chosen product, collection, or blog post. Add details on availability, style, or even provide a review.