Pay Off Student Debt

Paying Off Student Debt: A Guide to Financial Freedom

Why Tackling Student Debt Matters

For many students, loans are a necessary part of pursuing higher education, but managing and eventually paying off student debt can feel overwhelming. By taking control of your finances early, you can reduce stress, improve your financial health, and open doors to future opportunities. This guide is here to help you strategize and succeed in paying off your student loans efficiently.

Step 1: Understand Your Loans

Knowledge is power when it comes to managing debt. Start by gathering all the details about your student loans:

- Loan Type: Are your loans federal, private, or a mix?

- Interest Rate: Know which loans have the highest rates to prioritize repayment.

- Repayment Terms: Check the timeline, minimum monthly payments, and any grace periods.

- Servicer Contact: Keep the contact information for each loan servicer handy.

Tip: If you’re in the Netherlands or other EU countries, look into student loan repayment plans offered by local financial institutions or government programs. They often have favorable terms compared to private lenders.

Step 2: Budget Like a Pro

Creating and sticking to a budget is essential for paying off debt. Use the following steps to get started:

- Track Your Expenses: Use apps or spreadsheets to see where your money is going.

- Prioritize Needs Over Wants: Focus on essentials like rent, food, and loan payments.

- Set Aside Extra for Debt Repayment: Allocate any surplus toward your highest-interest loan.

Pro Tip: Adopt the 50/30/20 rule—50% for needs, 30% for wants, and 20% for savings or debt repayment.

Step 3: Explore Repayment Strategies

There’s no one-size-fits-all approach to paying off debt, but these strategies can help:

- Avalanche Method: Focus on loans with the highest interest rate first to save money over time.

- Snowball Method: Start with the smallest loan to gain momentum as you pay it off quickly.

- Refinance or Consolidate: Combine loans into one with a lower interest rate (only if it saves you money).

- Increase Monthly Payments: Even a small amount above the minimum can reduce your loan term significantly.

Step 4: Take Advantage of Resources

Leverage every tool available to ease the repayment process:

- Income-Driven Repayment Plans: For federal loans, tie your payments to your income.

- Employer Assistance: Some companies offer student loan repayment benefits.

- Tax Deductions: Check if you qualify for deductions on student loan interest.

- Scholarships and Grants: Apply for retroactive scholarships or grants to offset costs.

In the Netherlands: Research specific programs like “DUO”, which offers income-sensitive repayment plans for Dutch and international students.

Step 5: Avoid Common Pitfalls

- Skipping Payments: Even missing one payment can harm your credit score.

- Taking on New Debt: Avoid unnecessary loans or credit card debt until you’ve made significant progress.

- Ignoring Your Loans: Stay proactive—loan balances grow quickly with interest.

Step 6: Celebrate Small Wins

Paying off student debt is a journey. Celebrate milestones along the way, like paying off your first loan or reaching a savings goal. Positive reinforcement can keep you motivated.

Call to Action

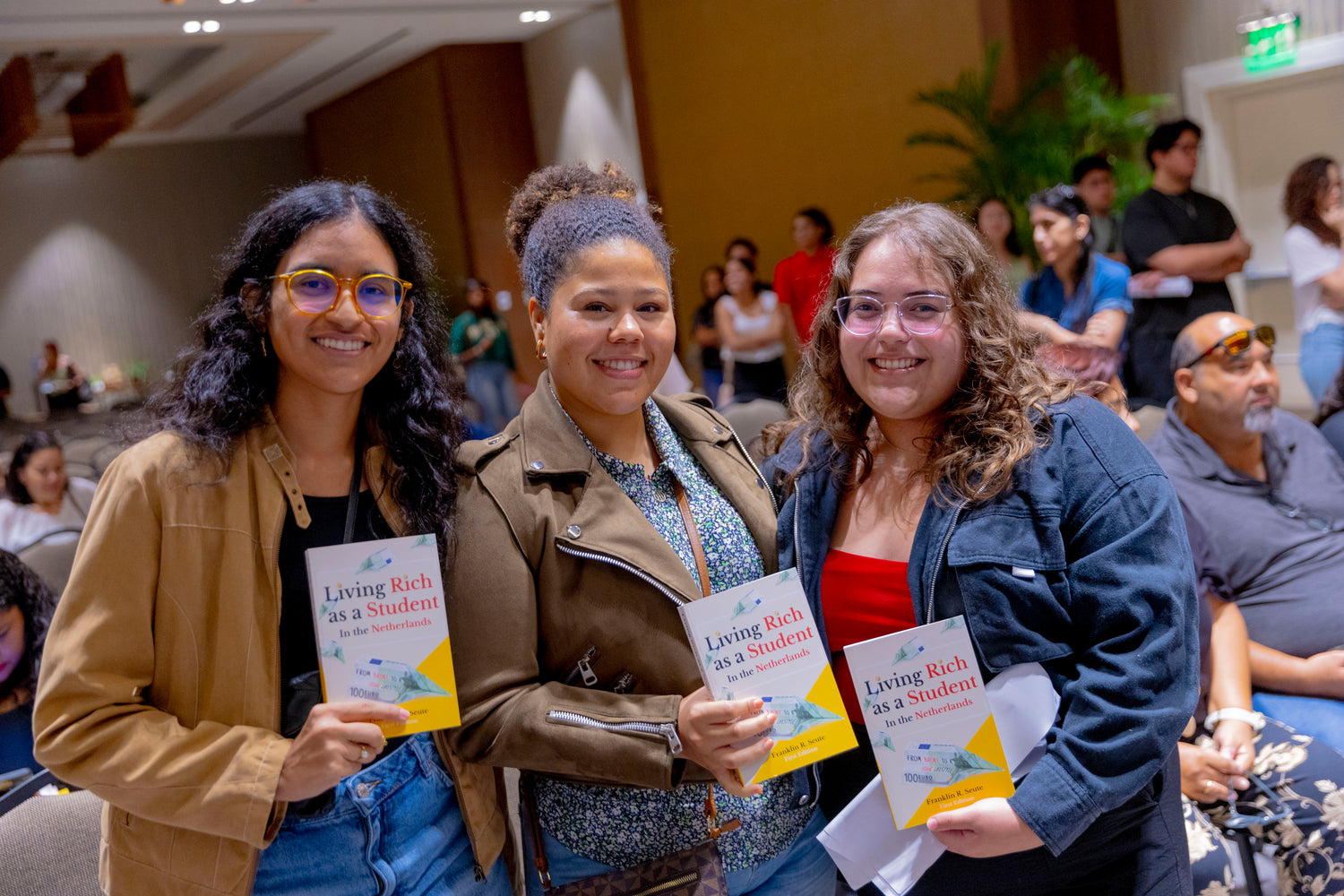

Ready to take charge of your student loans? Use this guide as your roadmap to financial freedom. For more tips on living richly and managing finances, check out Living Rich as a Student in the Netherlands.

Share Your Success Story Have you made progress paying off your student loans? Share your journey with our community for a chance to inspire others!

Brian, Hogeschool Amsterdam Student

Helpful, guidance and realistic!

"I liked that you summarized at the end of each chapter. The book helped me keep my monthly subscription and expenses on a low budget."

Caption

Row

Pair text with an image to focus on your chosen product, collection, or blog post. Add details on availability, style, or even provide a review.

Caption

Row

Pair text with an image to focus on your chosen product, collection, or blog post. Add details on availability, style, or even provide a review.