Our Events

We host a variety of events designed to help students like you build financial literacy, expand your professional network, and enhance your student experience. Whether you're interested in workshops, networking events, or exclusive career fairs, there's something for everyone.

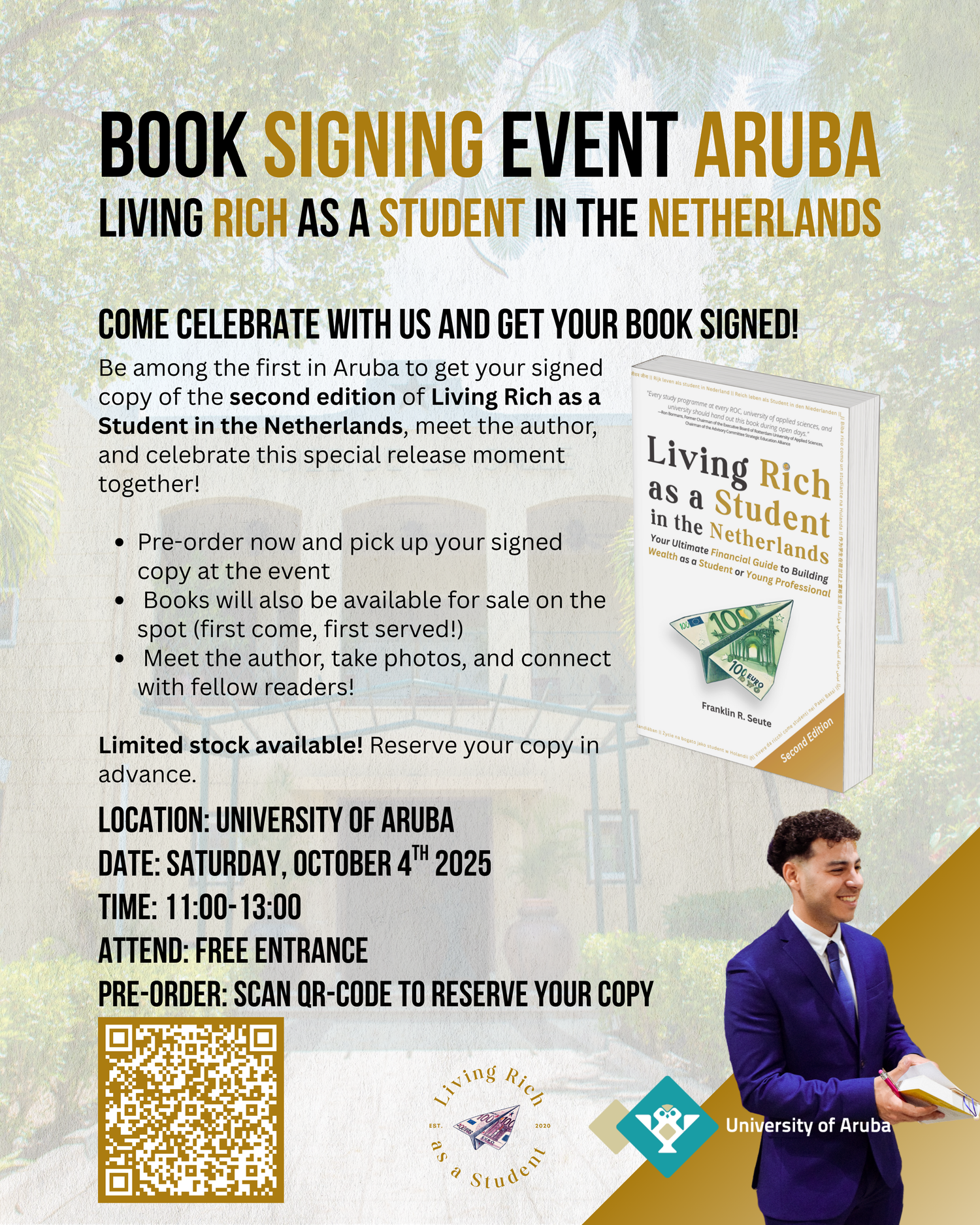

Saturday, October 4th, 2025

Book Signing Event Aruba

Be among the first on Aruba to get your signed copy of the second edition of Living Rich as a Student in the Netherlands, meet the author, and celebrate this special release moment together!

📍 The Universit of Aruba, Oranjestad

📅 Saturday, October 4th, 2025

🕑 11:00 – 13:00

Limited stock available

You can reverve a copy of Living Rich as a Student in the Netherlands below.

March 6, 2025 - Aruba Chamber of Commerce

From Paycheck to Wealth: Money Management for Beginners

From Paycheck to Wealth: Money Management for Beginners is designed for young professionals and aspiring entrepreneurs who want to take control of their finances and build a strong foundation for long-term wealth.

July 13, 2024 - Hyatt Regency Aruba

Workshop Budgeting for Students

Learn how to manage your money as a student in the Netherlands and Aruba.

June 15, 2023 - J.F.K Education Center Aruba

Workshop Budgeting for Students

Learn how to manage your money in the Netherlands.

June 8, 2023 - Centrale Bank van Curacao en Sint Maarten

Money Management for Students

Learn how to manage your money in the Netherlands.

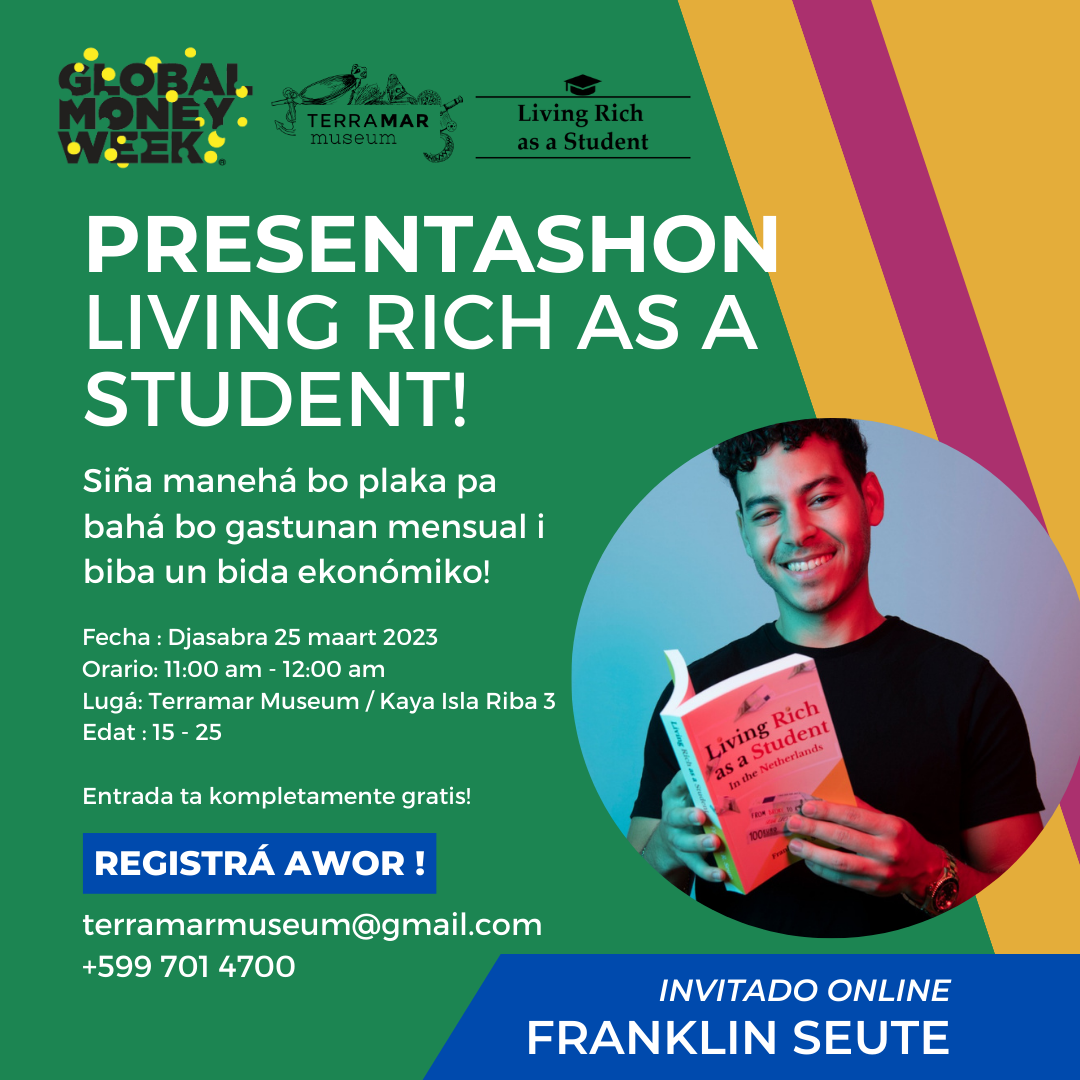

March 25, 2023 - Bonaire

Global Money Week

Learn how to manage your money to reduce your monthly expenses and live frugally.

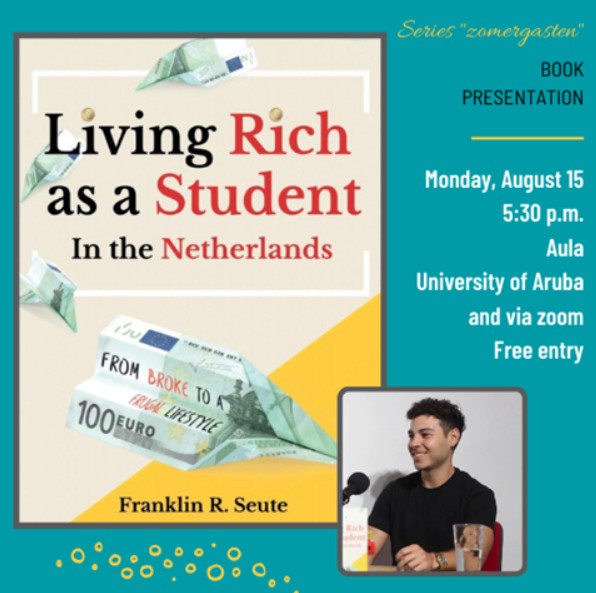

August 5, 2022 - University of Aruba

Book Presentation University of Aruba

This lecture is about how you can live a “rich” student life by living frugally as a student in the Netherlands.

July 17 and 19, 2022 - J.F.K Education Center Aruba

Workshop Budgeting for Students

How to manage your money abroad.

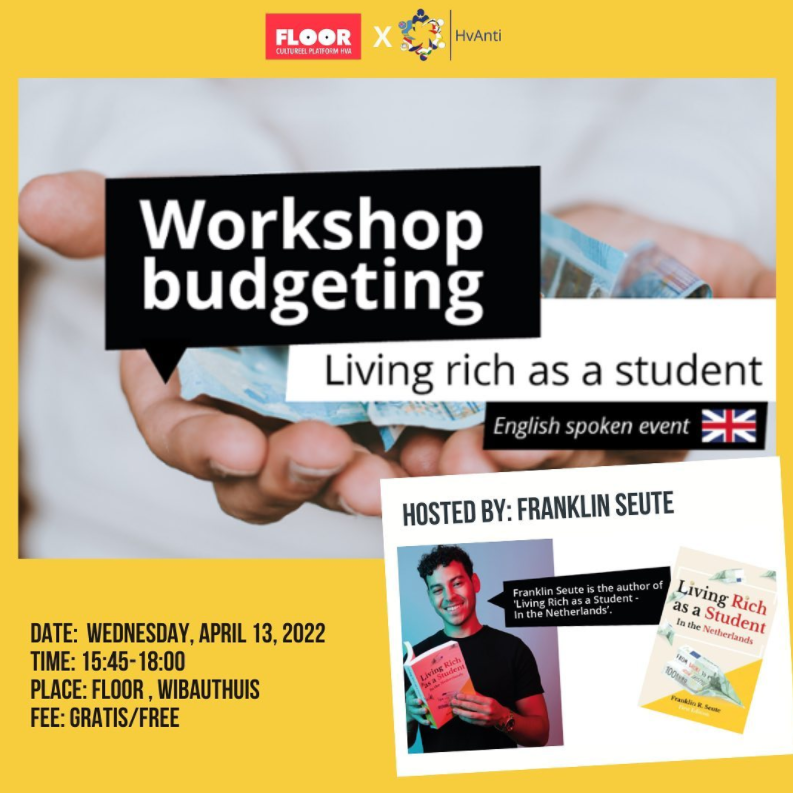

April 13, 2022 - Hogeschool van Amsterdam

Workshop Budgeting: Living Rich as a Student

View Highlights

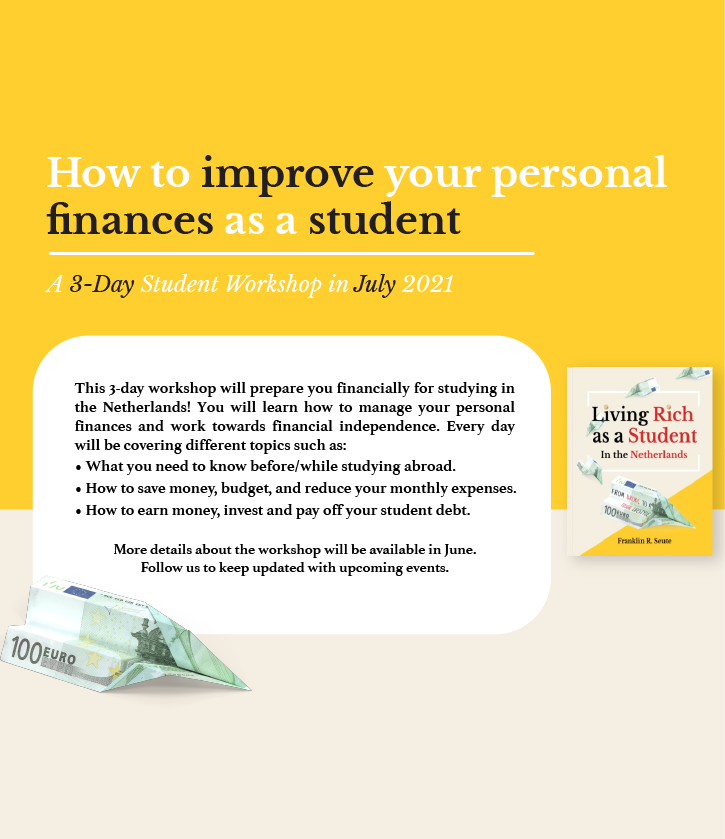

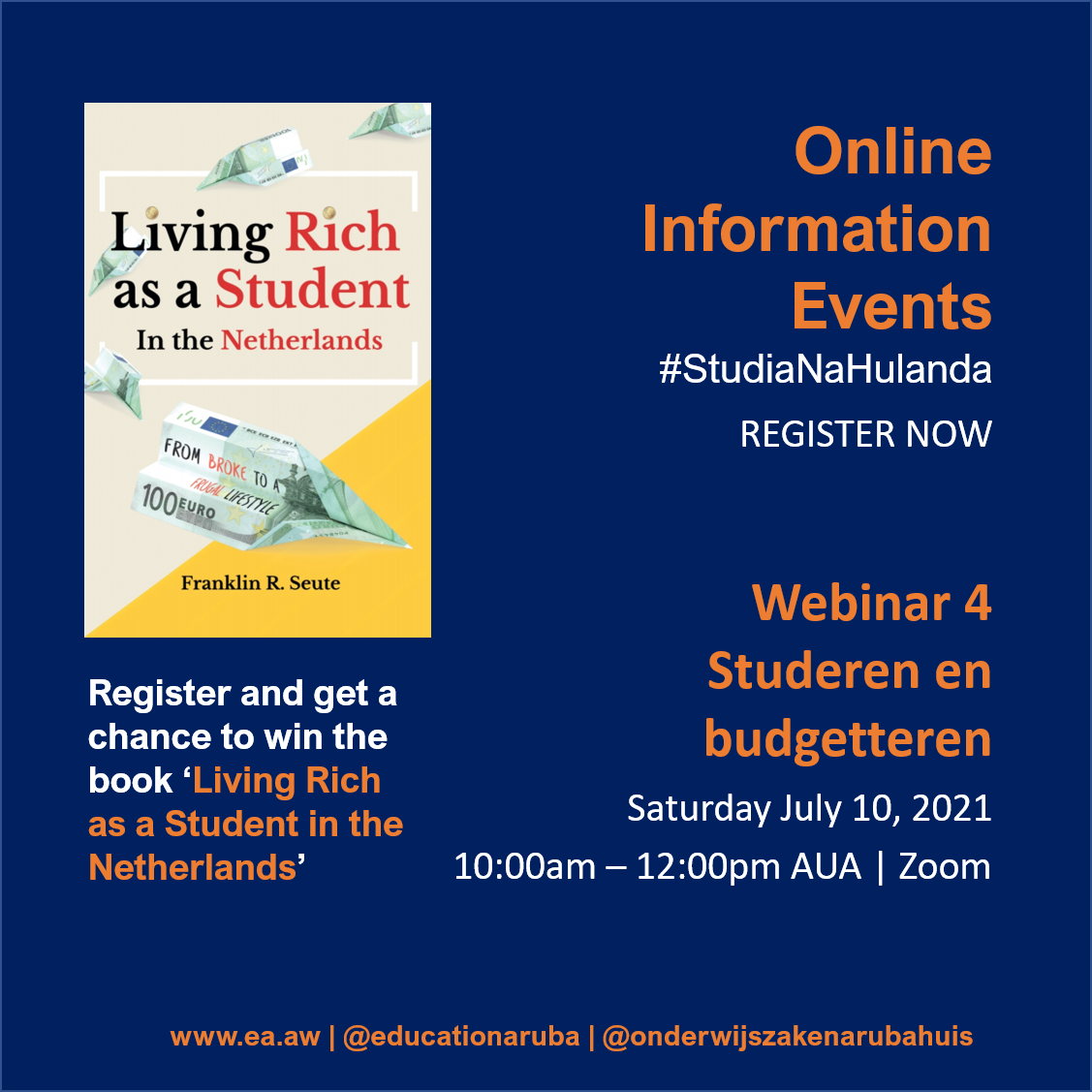

July 10, 2021 - Aruba (Online)

Studeren en Budgetteren

Information session about budgeting organized by Arubahuis for students traveling to the Netherlands.

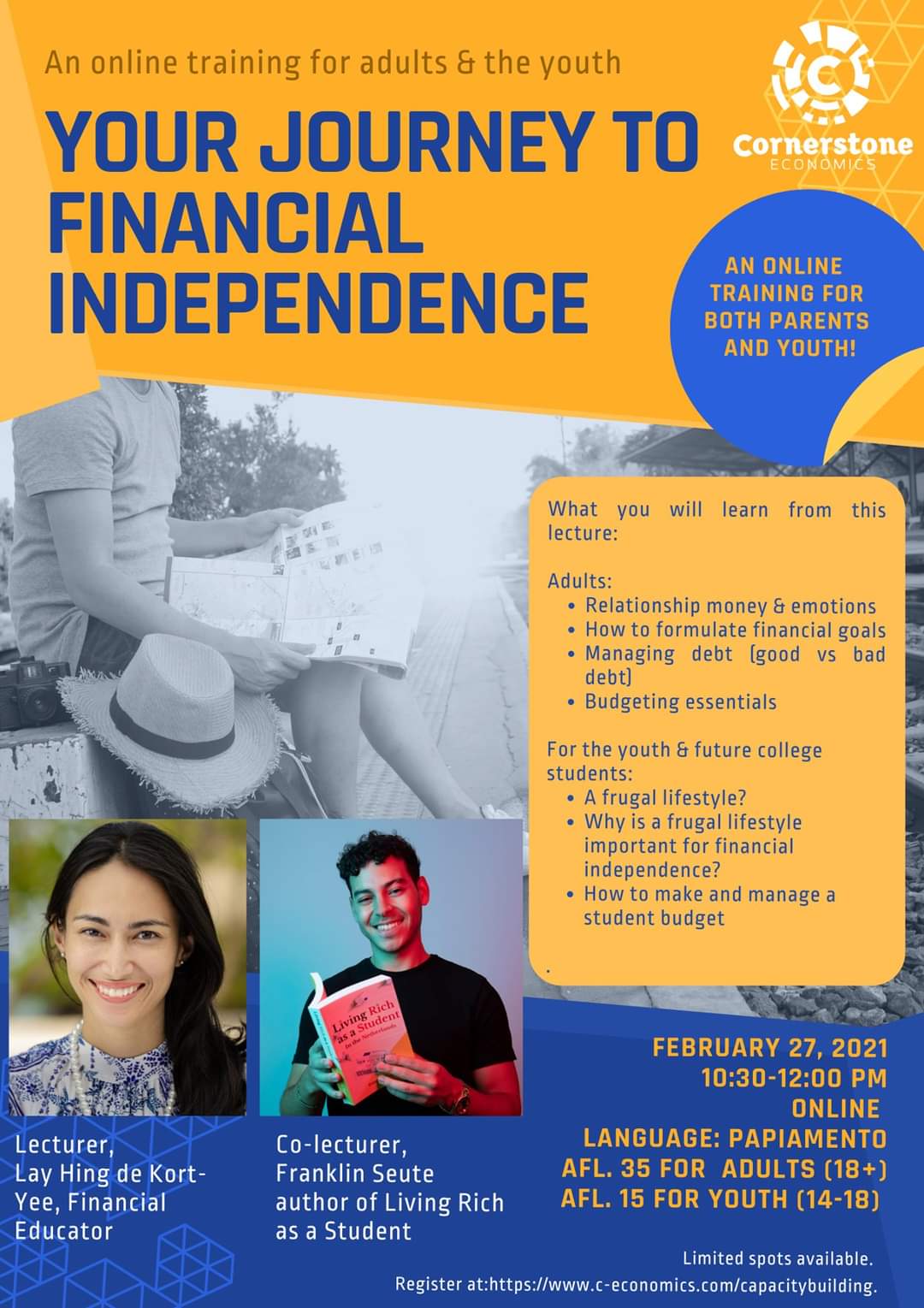

February 27, 2021 - Aruba (Online)

Your Journey to Financial Independence

An online training for both parents and the youth.

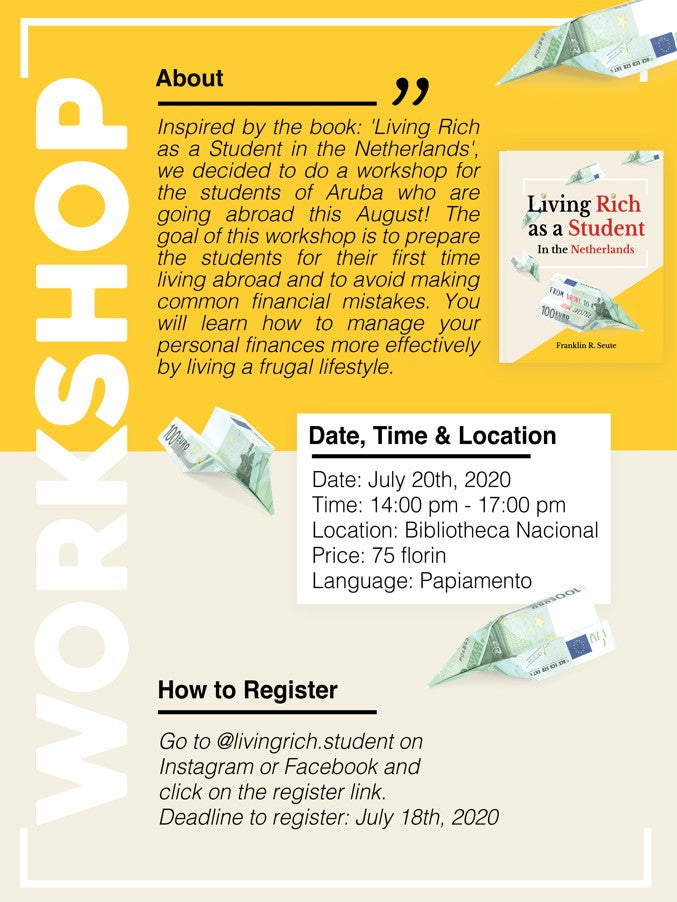

July 20, 2020 - Biblioteca National Aruba

Our First Budgeting Wokshop

Even before the launch of the first edition, we organized a budgeting workshop to help prepare students for their first time living abroad and to avoid making common financial mistakes.