Best Investment Apps for Students in the Netherlands: What to Consider Before You Start

Do you invest as a student? How many investment apps do you use? More importantly, are you aware of the risks involved?

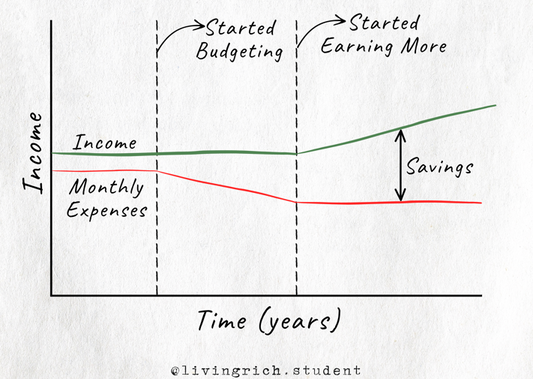

Investing can be a powerful tool for achieving financial independence. Once your personal finances are in order, investing can help you grow your wealth and create additional income streams over time. However, before jumping in, it’s essential to research what to invest in and which platform suits your needs.

In the Netherlands, several investment apps are available, including Revolut, eToro, Trading 212, Peaks, Bux, and DEGIRO. But with so many options, how do you choose the right one? Here are six key factors to consider before using any investment app:

1. Security & Trustworthiness

Your money should be safe. Choose platforms regulated by financial authorities such as AFM (Netherlands), FCA (UK), SEC, or FINRA (US). A regulated platform follows strict guidelines to protect investors.

2. Fees & Transparency

Hidden or high fees can eat into your returns over time. Always check:

✅ Trading fees

✅ Withdrawal fees

✅ Currency conversion fees

The lower the fees, the better for your long-term gains.

3. Minimum Deposits & Withdrawal Rules

If you're starting with a small budget, avoid platforms with high minimum deposits or withdrawal restrictions. Some apps offer no minimum deposit, making it easier for students to start investing.

4. Education & User Experience

A beginner-friendly app should provide:

📚 Educational content – tutorials, videos, and investment insights

📱 Easy navigation – a simple, intuitive design to help you make informed decisions

5. Customer Support

Reliable support is essential in case something goes wrong. Look for apps that offer:

💬 Live chat

📞 24/7 customer service

📖 A well-structured FAQ section

6. Ratings & Reviews

Before signing up, check user reviews on safety, fees, features, and customer service. A high-rated app with strong feedback is more likely to provide a positive experience.

My Favorite Investment Apps as a Student in the Netherlands

As an international student, I personally use DEGIRO, Revolut, and Trading 212:

✔️ DEGIRO – Great for ETFs (exchange-traded funds) with low fees and a wide range of options.

✔️ Revolut – Ideal for U.S. stock trading and cryptocurrencies with easy access to banking features.

✔️ Trading 212 – Commission-free trading with a user-friendly interface, great for beginners exploring stocks and ETFs.

All three platforms offer solid investment opportunities with competitive fees. I’ve had a positive experience using them and plan to continue. What investment app do you recommend?