8 Practical Ways to Save Money as a Student in the Netherlands

How to Save Money as a Student in the Netherlands

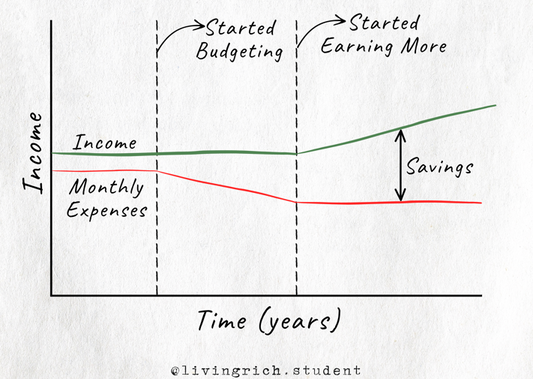

The Netherlands is a fantastic place to live and study, but it can also be quite expensive. Managing your personal finances effectively is crucial to avoid financial stress. When I first arrived in the Netherlands in 2015, my monthly expenses were significantly higher because I didn't know much about budgeting. However, after living here for several years and researching money-saving strategies, I discovered eight effective ways to save money as a student. Let’s dive in!

1. Track and Define Your Monthly Expenses

The first step in saving money is understanding where your money goes each month. Tracking your expenses helps identify areas where you can cut costs. Student living costs typically range from €800 to €1,300 per month, depending on your lifestyle and location (Amsterdam, for instance, is more expensive than smaller cities like Tilburg). Common monthly expenses include:

- Rent & Utilities

- Tuition Fees

- Health Insurance

- Groceries

- Transportation

- Clothing

- School Supplies

- Leisure (Gym, Netflix, Takeout, etc.)

- Mobile Subscription

To reduce costs, consider shopping at affordable supermarkets like Lidl and Aldi instead of Albert Heijn. Use the app 'Alle Folders en aanbiedingen' to find the best grocery deals. Additionally, cycling instead of using public transport can save you a lot over time.

2. Create a Student Budget

A well-planned budget keeps you in control of your spending. By listing your income and expenses, you can set realistic financial goals and avoid unnecessary spending. Several budgeting apps, such as Dyme or the app of your bank, can help you stay on track.

3. Build an Emergency Fund

Having an emergency fund is crucial for unexpected expenses. Ideally, you should save three to six months' worth of expenses. If your monthly expenses are around €1,000, aim to set aside €3,000 to €6,000 for emergencies. This will give you financial security and reduce stress.

4. Apply for Government Allowances (If Eligible)

As a student in the Netherlands, you may qualify for financial support from the government to cover rent and health insurance. Check the Belastingdienst website (www.belastingdienst.nl) for eligibility. Available allowances include:

- Healthcare Allowance (Zorgtoeslag) – Available if you study and work in the Netherlands.

- Rent Allowance (Huurtoeslag) – If you're over 23 and your rent is below a certain threshold, you could receive up to €360 per month in assistance.

Before applying, ensure you meet all requirements to avoid penalties.

5. Apply for Tax Remissions on Municipal Taxes (If Eligible)

If you have a low income, you may qualify for tax remissions (kwijtschelding) on municipal taxes, including:

- Water system tax

- Water treatment tax

- Sewage charge

- Waste charge

These taxes can add up to hundreds of euros per year, so applying for remissions can lead to significant savings.

6. File a Tax Return for Potential Refunds

If you work part-time, your employer might withhold too much tax from your paycheck. You can reclaim any excess taxes by filing an annual tax return with the Belastingdienst. Many students receive refunds of several hundred euros each year.

7. Reduce Monthly Subscription Costs

Streaming services, gym memberships, and digital subscriptions can eat into your budget. A smart way to cut costs is by sharing family or group subscriptions for services like Netflix, Spotify, and Disney+. This can reduce your subscription expenses by up to 75%, saving you hundreds of euros annually.

8. Adopt a Frugal Lifestyle

Being frugal doesn’t mean being cheap—it means being smart with your money. Many wealthy individuals practice frugal habits to accumulate wealth. Here are some easy frugal tips:

- Live within your means

- Buy in bulk to save money

- Shop second-hand for clothes, furniture, and electronics

- Use budgeting tools and plan your expenses wisely

By implementing these eight money-saving strategies, you can potentially cut your expenses by €500 per month. Managing money wisely as a student will set you up for financial success in the future.

For a more in-depth guide on saving and managing money in the Netherlands, check out the book Living Rich as a Student in the Netherlands: From Broke to a Frugal Lifestyle.