How I Saved My First €10.000 on a Student Budget (and How You Can Too)

When I was a student, I used to think saving a substantial amount of money was only possible after graduation. I believed that once I had a full-time salary, then I could start building real wealth.

However, halfway through my studies, I realised I didn’t need to wait. I could take control of my finances right where I was, as a student in the Netherlands.

I began tracking every euro I spent, cutting unnecessary costs, and creating a smarter budget. But I also learned an important truth: reducing expenses is only half the equation. To save faster, I needed to earn more as well.

That’s when I started freelancing and delivering for Deliveroo and Uber Eats on weekends. I discovered that with the right habits, you don’t have to wait for a degree to improve your financial future.

By combining expense reduction with income growth, I managed to save between €500 and €800 every month. Two years later, I had reached my goal of saving €10.000, all while still in school.

Method #1: Define & Reduce Your Monthly Expenses

The first step is awareness. You need to know exactly where your money is going each month. Once you have a clear picture, you can identify which expense categories to cut back on.

Here’s how I reduced my expenses as a student in the Netherlands:

- Applied for rent allowance, saved €300/month

- Applied for healthcare allowance, saved €120/month

- Got remission on municipal taxes, saved €350/year

- Shopped at the farmers market for affordable fruits and vegetables, saved €20/week

- Split my Spotify & Basic-Fit membership with a friend, saved €17/month

These small changes added up quickly, freeing up hundreds of euros every month.

Method #2: Increase Your Income

Once my expenses were under control, I focused on earning more.

Here’s how I boosted my income:

- Deliveroo & Uber Eats, 10 hours per week, earning about €200/week

- Freelancing via Temper, earning €20/hour, averaging €300/month

Even a few extra hours of work each week made a significant difference over time.

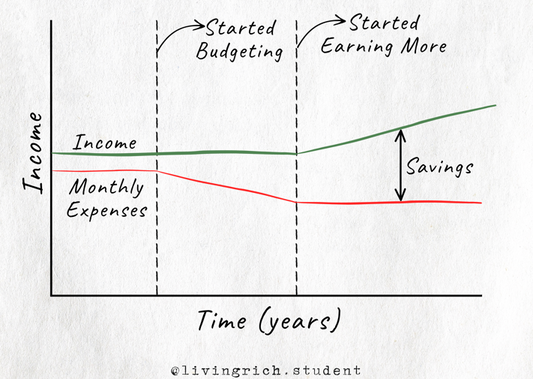

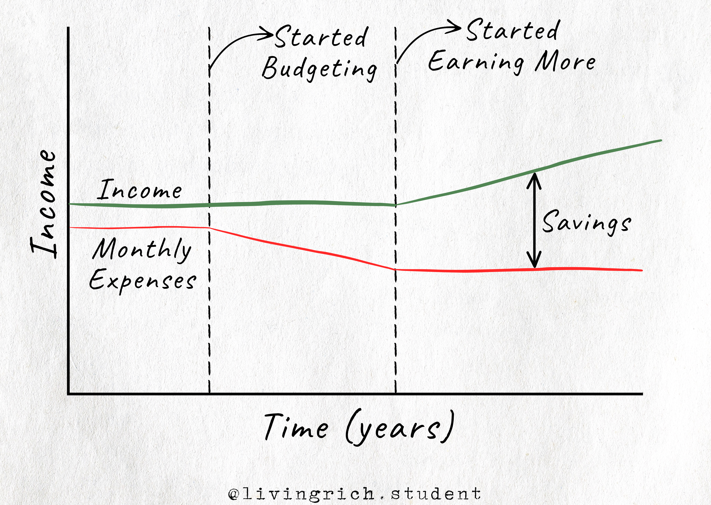

The Result: A Growing Savings Gap

By lowering my expenses and increasing my income, I widened the gap between what I earned and what I spent. This “savings gap” is the key to building wealth, no matter your income level.

In my case, this gap allowed me to save €500–€800 every month. In just two years, I reached my €10.000 savings goal.

Want the Complete System?

These are just a few strategies from my upcoming book, Living Rich as a Student in the Netherlands, Second Edition. Inside, you’ll learn:

- Why Budgeting is Freedom (Chapter 3)

- How to Define & Reduce Your Monthly Expenses (Chapter 4)

- 8 Ways to Earn Money as a Student (Chapter 6)

- How I manage my money with the Five-Bucket System (Chapter 5)

- How to Become a Student Investor (Chapter 9)

- The Three Income Tax Boxes in the Netherlands (Chapter 7)

- How to Pay Back Your Student Loan (Chapter 8)

If you’re ready to take control of your finances as a student, this book will give you a step-by-step plan to save money faster, spend smarter, and start building wealth while studying.